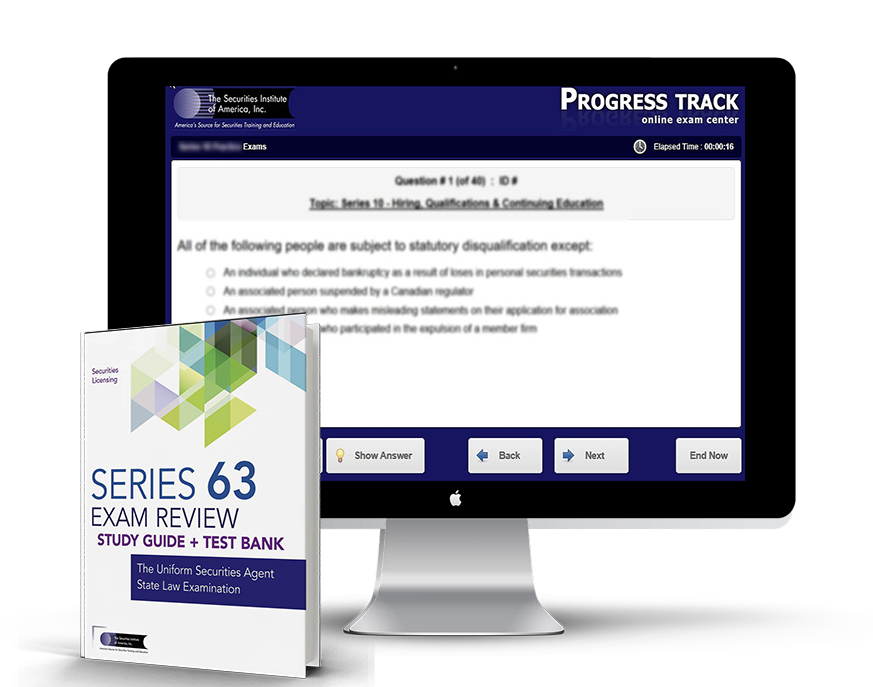

Pass the NASAA Uniform Securities Agent Law Exam on your first attempt. Our training course provides you with the best series 63 study materials. Our series 63 exam prep maintains the highest pass rates in the industry. Using proven strategies for success. Our Series 63 Licensing program features:

Become an expert on state regulations and the powers of the state securities administrator for your series 63 exam with our best in class series 63 study materials

$149.00

$ 149.00

$ 109.00

$ 124.99

Series 63 Combination Packages

All of our combination packages are discounted. Check out the prices! Purchase one of the following combination packages if you are really serious about passing your exam in the quickest possible time.

Series 63 Important Concepts

Sometimes a security that would otherwise have to register is exempt from state registration because of the type of transaction that is involved. The following are all exempt transactions:

A private placement is a sale of securities that is made to a group of accredited investors and the securities are not offered to the general public. Accredited investors include institutional investors and individuals who:

Read moreThe state securities administrator has the authority to enforce all of the provisions of the Uniform Securities Act (USA) within their state. The state securities administrator may deny, revoke, or suspend the registration of a security, an agent, or a firm. The administrator may also revoke an exemption from registration, subpoena and investigate any registrant, and amend rules as required. The North American Securities Administrators Association or NASAA is the oldest investor protection organization in the country and represents the interest of all of the state securities administrators. NASAA also writes policies and administers the Series 63, 65, and 66 exams.

Read morePrior to conducting business in any state, a broker dealer must be properly registered or exempt from registration in that state. The first test when deciding if the broker dealer must register is determining if the firm has an office in the state. If the firm maintains an office within the state it must register with that state. An agent must register in their state of residence even if their firm is located in another state.

Example:

An agent who lives in New Jersey and who commutes to their office in New York must register in both New Jersey and New York.

All securities that are sold to a state residence must either be:

Exempt securities are exempt from the registration requirements of The Securities Act of 1933. Exempt securities are not exempt from the antifraud provisions of the USA. Exempt securities are:

Read more

2025 © Securities Institute, All Rights Reserved.

Privacy Policy | Terms of Service.